|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

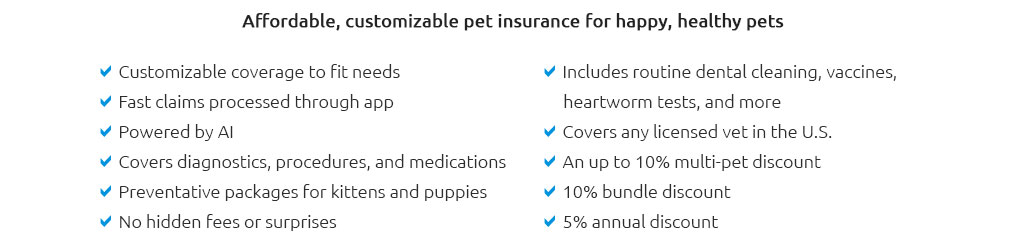

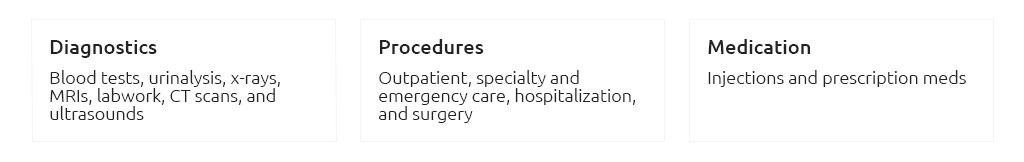

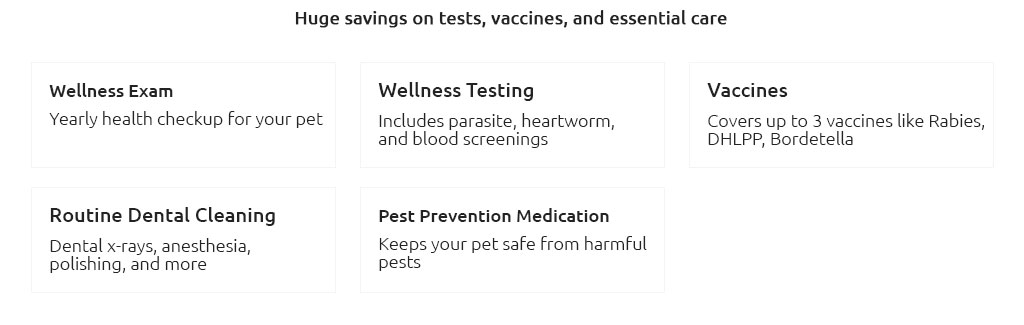

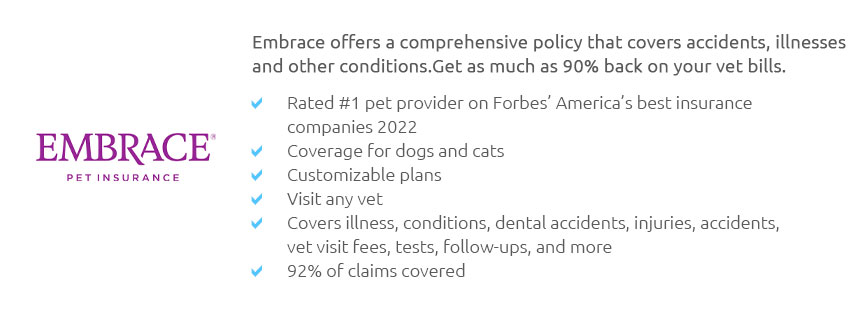

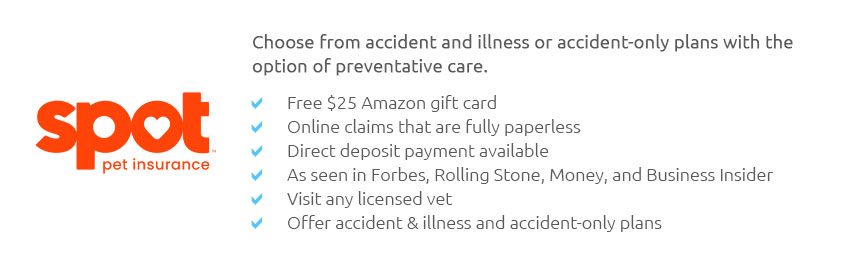

Compare Pet Insurance Costs: Understanding the Benefits and OptionsIntroduction to Pet InsurancePet insurance can be a lifesaver for pet owners, providing financial protection against unexpected veterinary expenses. However, with numerous options available, it's essential to compare pet insurance costs to ensure you find the right policy for your pet's needs and your budget. Factors Influencing Pet Insurance CostsBreed and Age of Your PetThe breed and age of your pet significantly affect the insurance premium. Some breeds are more prone to health issues, and older pets often require more medical attention, leading to higher costs. For more tailored options, consider exploring affordable pet insurance for older dogs. Coverage OptionsInsurance policies vary in the coverage they offer, from accident-only plans to comprehensive policies that cover illnesses, preventive care, and even alternative therapies. The more extensive the coverage, the higher the premium.

Benefits of Comparing Pet InsuranceCost EfficiencyBy comparing different pet insurance plans, you can find a policy that provides the necessary coverage at a competitive price. Look for policies with good value, balancing premium costs with coverage benefits. Consider visiting affordable pet health insurance for more cost-effective solutions. Better Understanding of Policy TermsComparing policies helps you understand the terms and conditions, exclusions, and limits, ensuring that you are well-informed before making a decision. This knowledge can prevent unpleasant surprises when you need to file a claim. Steps to Compare Pet Insurance

FAQWhat does pet insurance typically cover?Pet insurance usually covers accidents and illnesses, including surgeries, medications, and hospitalizations. Some plans also cover routine wellness care like vaccinations and check-ups. How can I reduce my pet insurance costs?To reduce costs, choose a higher deductible, opt for accident-only coverage, or insure your pet when they are young and healthy. Additionally, comparing policies can help you find more affordable options. Are there any exclusions in pet insurance policies?Yes, most pet insurance policies exclude pre-existing conditions, elective procedures, and certain hereditary conditions. Always read the policy details to understand specific exclusions. https://thepetdoctorinc.com/wp-content/uploads/2019/04/veterinary-pet-insurance-comparison-chart-printable.pdf

costs. Plans with wellness. (like Whole Pet Plan) or plans with a wellness rider are available. Two tiers of routine care coverage are available. Not. https://www.progressive.com/answers/pet-insurance-cost/

The average accident and illness plan pet insurance premium in 2022 was $53.34 per month for dogs, and $32.25 for cats. https://www.pawlicy.com/blog/pet-insurance-cost/

The average cost of pet insurance for accident & illness coverage in the U.S. is $56.30/mo ($675.61/year) for dogs and $31.94/mo ($383.30/year) for cats.

|